Independent Wealth Advice for a Confident Retirement

Giliker Flynn Independent Wealth Ltd helps you turn pensions and investments into a personalised retirement plan with clarity and care.

Free ConsultationWho We Are

Giliker Flynn provide independent, unbiased retirement advice, with a sole focus on achieving the best outcomes for our clients, whilst providing excellent service along the way. We acknowledge that although this part of our website is 'About us', everything that we do is very much 'About you'.

Our approach is to create a relaxed friendly environment and build strong relationships based on trust and confidence. We manage your expectations, explain our recommendations in a way you fully understand, and ensure you feel completely comfortable and confident with the decisions that you make.

We are regulated and authorised by the Financial Conduct Authority, and have been awarded the Chartered status, which is something we are particularly proud of.

Our Story

The business was originally set up in January 2015 by Frances Giliker and Chris Flynn. They are husband and wife and work within the business alongside the rest of our passionate team.

The clients that we typically help and provide most value for, are people that have existing pension provision worth at least £200,000 and are either thinking about retiring, approaching retirement, or are at their retirement date.

Our Head offices are based in the West Midlands in Newcastle under Lyme, Staffordshire, and our services benefit clients from across the whole of the United Kingdom.

Charity Work

In addition to being passionate about doing a great job for our clients, we also support a children's charity called the Peter Pan Centre based in Staffordshire. They specialise in helping children with special needs have the best possible start to life.

The whole team all play an active part in supporting the charity which has included running marathons, organising golf days and charity auctions, along with other fundraisers and making donations.

Our Approach

Our approach is to create a relaxed friendly environment and build strong relationships based on trust and confidence. We manage your expectations, explain our recommendations in a way you fully understand, and ensure you feel completely comfortable and confident with the decisions that you make.

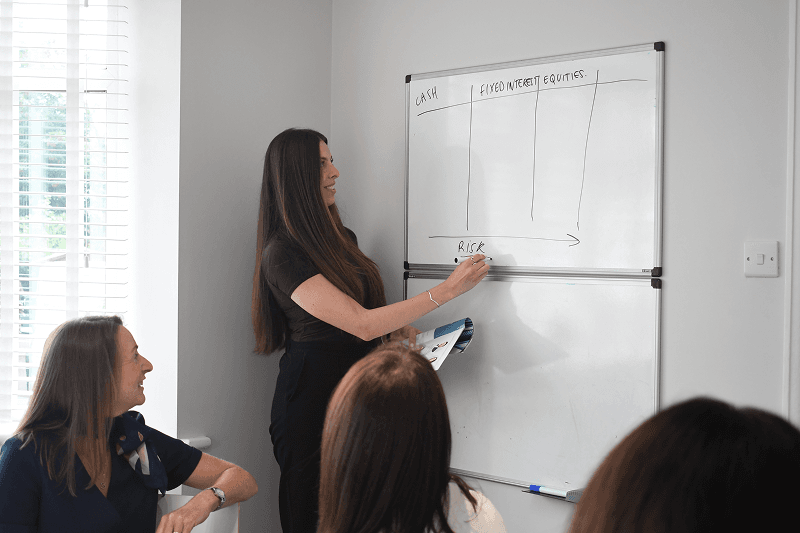

We Simplify the Choices

Understand your pension options without the overwhelm.

Highlight Key Risks

See potential pitfalls before making decisions.

Balanced Strategies

Get recommendations that blend flexibility with guaranteed income.

Client Journey

Our typical client journey follows these six clear stages:

Free Initial Consultation

The first step in our process is to arrange a free initial consultation with you to understand your objectives, and your full circumstances. This also enables you to become more familiar with who we are and what we do. We will also look to obtain your permission to gather all the relevant information from your existing pension or investment plan provider where necessary.

Due Diligence

We will gather the information from your plan provider and complete a summary of all the key information so we have a clear understanding of what you currently have in place, the options available, and whether your plan is suitable to meet your objectives.

Follow Up Free Consultation (if necessary)

On completion of our due diligence we will arrange a follow up 'free' consultation with you to have a more meaningful discussion about which way we move forward.

Commitment

This is when you need to make a decision on whether you wish to instruct us to provide you with advice. You will receive a terms of engagement letter from us summarising some key information to help you be sure you wish to move forward.

Recommendations and Sign Up

Your adviser will present their recommendations to you, and if you are happy for the advice to be implemented, the relevant application forms will be completed so that your new plan/s can be arranged and set up successfully for you.

Optional On-going Reviews

Once your plan has been incepted, should you opt for our on-going servicing, you will qualify for annual reviews, and for us to be a full time point of contact for you.

Our Fees

Transparent pricing with no hidden costs

We charge a 'one off' initial fee to provide you with independent advice.

However, before committing to any fee, we typically offer you two free initial consultation meetings (if necessary), to help you understand more about who we are, have meaningful discussions about the options available, and agree which way we move forward. We also put a summary of our terms and your objectives together in writing. This prevents any confusion and enables you to feel completely comfortable before making any commitments.

Initial Advice Charge

Our fee structure is tiered, and reduces in percentage terms if your plan value is more than £200,000.

| Plan Value | Fee % | £200k Example | £500k Example | £900k Example |

|---|---|---|---|---|

| £0 to £200,000 | 2.00% | £4,000.00 | £4,000.00 | £4,000.00 |

| £201,000 to £500,000 | 1.00% | - | £3,000.00 | £3,000.00 |

| £501,000 to £1 million | 0.5% | - | - | £2,000.00 |

| £1 million+ | Bespoke fee calculated | |||

| Total Fee | £4,000 (2%) | £7,000 (1.4%) | £9,000 (1.00%) | |

Optional On-going Servicing Charge

Any household total combined plan value up to £300,000 will be subject to 1% annual servicing fee.

Consideration will be given to reducing the annual service fee where the combined household plan value is greater than £300,000.

For other non-typical advice requirements, we will quote a bespoke fee to help you understand the cost for any work involved.

How We Help Clients

Build a bespoke retirement plan to meet your objectives

Calculate affordability so you know when you can retire

Explain every pension option in plain language

Optimise withdrawals for tax efficiency